How do Russians pay abroad ? Cash, cards, KoronaPay and cryptocurrencies

How do Russians pay abroad ? - is a question that the sanctions restrictions have made key. While Visa or Mastercard used to suffice, now travelers, tourists and especially property buyers need alternatives. In this detailed guide, let's break down the working payment methods in Turkey: cash, bank cards including UnionPay and foreign solutions, KoronaPay transfers and modern cryptocurrency instruments.

Who will find this article useful:

- Tourists planning a trip to Turkey

- Buyers of Turkish real estate

- Investors doing business in Turkey

- Everyone who is looking for alternative ways of international settlements

Under the sanctions restrictions, Russians can pay abroad in several ways: cash dollars and euros, UnionPay cards, transfers through systems like KoronaPay or cryptocurrency solutions. The choice of method depends on the amount, urgency and ultimate purpose of the payment.

We Recommend

Cash in Turkey, how to bring and where to safely exchange ?

Which banknotes to take and why it is important

Cash remains the most reliable way for Russians to make payments abroad in 2025. However, the choice of currency and the condition of banknotes are critical to a successful exchange.

Prioritize currencies for travel to Turkey:

- US dollars - accepted everywhere, best liquidity

- Euros - good exchange rates, wide acceptance

- Rubles - limited acceptance, unfavorable exchange rates

Critical requirements for dollar banknotes:

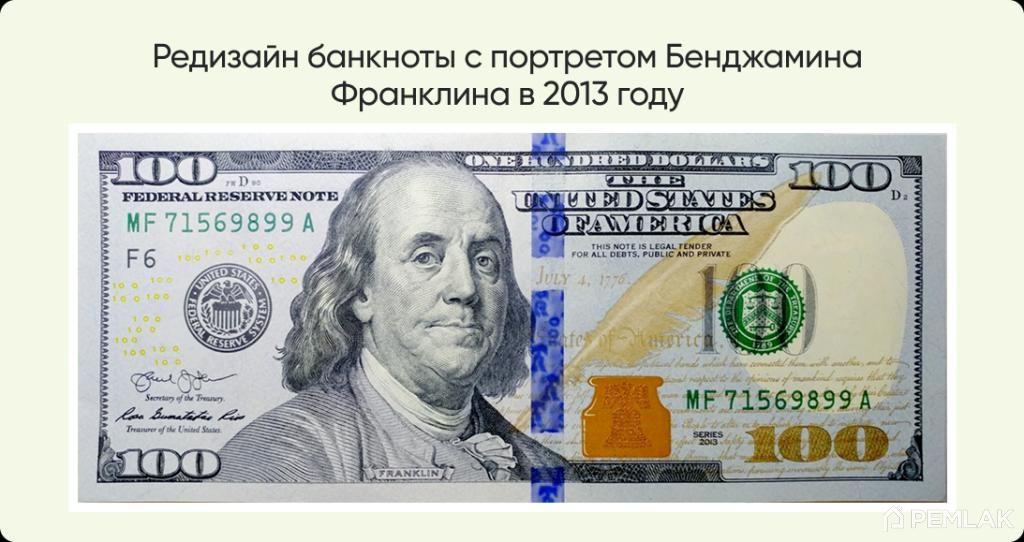

Turkish exchange offices and banks have become extremely selective about the quality of dollar bills. This is due to the increasing incidence of counterfeiting, especially of old series banknotes.

New hundred-dollar banknotes with blue protective tape are most readily accepted. These banknotes of the 2013 series and newer have improved security degrees and arouse less suspicion among exchangers.

Problem banknotes to avoid:

- Old $100s issued before 2009

- "White dollars" (older series without colored security features)

- Damaged, torn or badly worn bills

- Older series $50 bills

In 2024-2025, there was an increase in cases where Turkish banks and money exchangers temporarily refused to accept certain series of dollars due to spikes in counterfeiting. This led to situations where tourists with "ineligible" banknotes were unable to exchange them.

Cash preparation tips:

- Take large denomination banknotes ($100, €100, €50) in perfect condition

- Be sure to check banknotes in a Russian bank before traveling

- Have a stockpile of different denominations for small expenditures

- Take banknotes of different series in case one series is not accepted

Where to change cash in Turkey?

Exchange offices (döviz bürosu)

Advantages:

- Work longer than banks, including weekends

- Fast service without queues

- More favorable rates in tourist areas

- No documents required for small amounts

Disadvantages:

- Can be selective about the quality of banknotes

- Rates vary greatly between locations

- Less guarantees in case of disputes

Banks

Advantages:

- Reliability and official exchange rates

- Provide exchange certificates if necessary

- More loyal attitude to banknotes with minor defects

Disadvantages:

- Require passport when exchanging from 1000 dollars

- Longer service

- Limited opening hours

Main banks for currency exchange:

- Akbank

- İş Bankası

- Garanti BBVA

- Yapı Kredi

- Ziraat Bankası

Practical tips for exchanging

Prepare for possible rejections. Between 2024 and 2025, some exchangers and banks occasionally refuse to accept certain series of dollars. Always have a plan "B" - a list of alternate exchangers or banks in the same neighborhood.

Compare rates. The difference between the rates of different exchangers can be as much as 3-5%. In the tourist areas of Istanbul, Antalya, Bodrum usually more favorable rates than at the airport.

Documents for exchange. Passport is mandatory when exchanging amounts over symbolic thresholds (usually from $500-1000). Some banks require documents for any amount.

Rubles in Turkey or the reality of 2025

How to pay in Turkey to Russians in rubles is a question often asked by tourists. Unfortunately, the reality is this: rubles are accepted extremely limited.

Where you can exchange rubles:

- Some exchangers in areas with a high concentration of Russian-speaking tourists(Istanbul, Antalya)

- Individual banks by prior arrangement

- Unofficial exchangers (with high risks)

Theruble exchange rate in Turkey is significantly worse than the official rate of the Central Bank of Russia. Exchange losses amount to 10-20% of the fair value. This is due to the limited liquidity of the ruble and the difficulty of its further use by Turkish financial institutions.

Recommendation: Change rubles into dollars or euros back in Russia. This will avoid unfavorable rates and possible refusals to exchange.

Lifehacks for buyers of real estate

If your goal is to pay for real estate in Turkey, cash plays a special role, but has limitations.

The reservation and deposit stage:

- Cash is suitable for making an initial deposit for anapartment in Turkey

- This is usually 5-10% of the value of the property

- Get a receipt stating the exchange rate at the time of deposit

Exchange rate fixing: Several months may pass between the deposit and the final payment. During this time, the lira/dollar exchange rate can change significantly. Be sure to fix it in the contract:

- The currency of the final payment

- Conversion rate (if applicable)

- Who bears the currency risk - buyer or seller

Cash restrictions for real estate

Cash is not sufficient for full settlement in a real estate purchase. Turkish law requires:

- A certificate (currency purchase certificate) - obtained only with an official bank exchange or receipt of funds into a Turkish account

- Bank documents confirming the origin of funds - for amounts over $50,000

- Cashless transfer to the seller or a bank check - cash is not counted for titling in Tapu (cadastre)

Working scheme for real estate buyers:

- Cash dollars/euros you bring in for deposit and running costs

- Transfer the principal amount through the bank or exchange a large amount of cash in a Turkish bank with the receipt of a certificate

- Open an account in a Turkish bank (temporary or permanent)

- Receive a certificate

- Make cashless payment with the seller

Cash currency export limits:

Remember the cash currency export limit of 10,000 USD (or equivalent in other currencies) per person without declaration. If this amount is exceeded, a declaration must be completed at the border. Purchases of expensive real estate may require multiple trips or relatives may be required to carry cash within the limits.

Practical tip: When buying real estate worth more than $100,000, plan on mostly cashless methods of payment. Use cash only for down payment, running costs and realtor fees in Turkey.

Cards and transfers in Turkey, from UnionPay to KoronaPay

After considering cash payments, let's move on to modern methods of cashless payment abroad. In 2025, Russian tourists and investors can use several working solutions, each with its own peculiarities and limitations.

UnionPay, what really works in 2025 ?

UnionPay remains one of the few international payment solutions available to Russian cardholders, but the situation has changed dramatically with the onset of sanctions.

Which Russian banks issue UnionPay ?

As of 2025, UnionPay cards are issued by a limited list of Russian banks, including:

- Gazprombank - the most stable issuer

- ATB - limited product line

- Rosselkhozbank - corporate and premium cards

Important: some UnionPay bank cards stopped working outside Russia due to sanctions restrictions. Many issuers have suspended the issuance of new cards or limited their functionality outside Russia.

Does UnionPay work in Turkey?

The situation is unstable and requires constant monitoring:

- Spot acceptance: about 60-70% of large retail outlets in tourist areas

- Unstable: periodic blocking and restrictions

- ATMs: not all are working, 3-5% fees for cash withdrawals

- Online payments: mostonline stores do not support it

Practical advice: consider UnionPay as an additional payment method, not the only one. Be sure to have backup options.

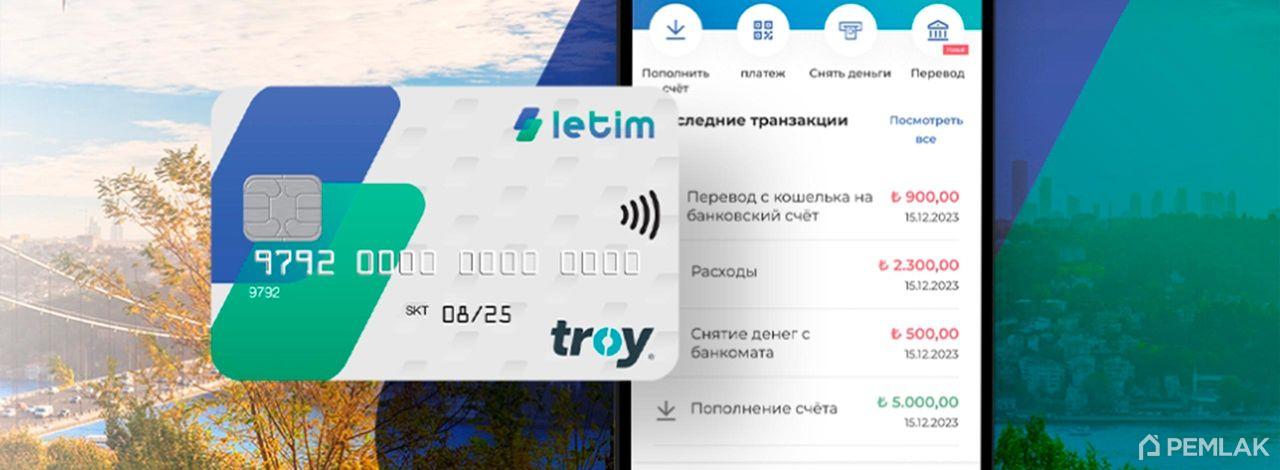

Letim Card

Letim is a fintech application that allows Russians to issue virtual and physical bank cards with the possibility of convenient top-up via SBP. The solution is suitable for use in Turkey.

Requirements for obtaining:

- Completion of registration in the Letim mobile application

- Proof of identity (KYC) using a foreign passport or Russian passport

- Indication of residential address

Features of letim:

- Replenishment: via SBP in rubles with automatic conversion to card currency

- Currencies: TRY

- Commissions: transparent tariff grid, no commission fee for top-up via SBP, conversion at market rate with minimal markup

- Limits: up to $10,000 per month for standard cards, higher for premium rates

- Geography: accepted only in Turkey, TROY payment system card

What are the advantages of Letim ?

- Simple remote issuance without visiting the bank

- Fast replenishment in rubles with crediting in lira

- Suitable for payment in stores and cafes in Turkey

- Possibility to order both virtual and physical cards with delivery to Russia!

Mir cards in Turkey

Acceptance of "Mir" cards by Turkish banks was stopped after the introduction of secondary sanctions. All major Turkish banks, including state-owned Ziraat Bank and VakifBank, stopped servicing the Russian payment system.

Foreign cards, where and how to open for Russians ?

Getting a bank card in friendly countries remains one of the most reliable ways to solve the problem of cashless payment abroad.

General requirements for non-residents

A foreign card for Russians requires compliance with standard banking procedures:

Remote issuance (rarely and with restrictions):

- Video interview with a bank specialist

- Notarized translations of documents

- Initial deposit from $1,000-5,000

- Limited card functionality

Personal presence (recommended):

- Passport and its notarized translation

- Income certificate or Russian bank statement

- Address of stay (rental agreement/hotel certificate)

- Local tax number (in some jurisdictions)

Armenia: available options

A non-resident canopen a card in Armenia with the following banks:

Ameriabank:

- Minimum deposit: $1,000

- Processing: 1-2 business days with personal visit

- Features: possibility of remote opening for VIP clients

- Currencies: AMD, USD, EUR

IDBank:

- Deposit: from $500 for basic products

- Requirements: proof of income in English

- Advantages: developed mobile application

- Commissions: 0.5-1% for currency transactions

ACBA Bank:

- Deposit: from $1,500 for non-residents

- Procedure: mandatory interview at the bank's office

- Cards: Visa and Mastercard of all categories

- Limits: up to $10,000 per day for premium cards

Kyrgyzstan: loyal banking environment

It is easier toopen a card in Kyrgyzstan due to more lenient regulation:

DemirBank KG:

- Features: special programs for Russians

- Deposit: from $300

- Registration: on the day of application

- Currency transactions: no geographical restrictions

Optima Bank:

- Minimum requirements to documents

- Deposit: from $200

- Advantages: low commissions for international transfers

- Disadvantages: limited ATM network outside CIS countries

Kazakhstan: traditional banking

It is possible toopen a card in Kazakhstan for a non-resident in major banks:

Halyk Bank:

- Status: the largest bank in Kazakhstan

- Requirements: personal presence is obligatory

- Deposit: from $1,000

- Features: wide international network of ATMs

Jusan Bank:

- Modern digital solutions

- Deposit: from $500

- Procedure: full verification of income sources

- Limits: flexible customization

Georgia: European standards

Leading banks offer toopen a card in Georgia for non-residents:

TBC Bank:

- Reputation: the most popular among Russians

- Requirements: tax resident status in Georgia (preferably)

- Deposit: from $1,000-2,000

- Advantages: integration with international payment systems

Bank of Georgia:

- Status: systemically important bank

- Procedure: strict compliance and verification of documents

- Special features: possibility to execute mortgage products

- Currencies: GEL, USD, EUR

Turkey: cards for non-residents

Acard in Turkey is available to aforeigner subject to strict requirements of Turkish banking regulations:

Mandatory conditions:

- Turkish tax number (Vergi Numarası)

- Address in Turkey with supporting documents

- Income certificate (translated and notarized)

- Deposit: from 10,000-50,000 liras depending on the bank

Recommended banks:

- Ziraat Bank: state-owned, loyal conditions

- Garanti BBVA: international service standards

- İşBankası: well-developed branch network

Practical difficulties:

- Strict compliance policy due to sanctions

- Need to know Turkish or English

- Lengthy verification procedures (up to 2-4 weeks)

Key questions for the bank when applying

When applying to any foreign bank, be sure to specify:

- SWIFT/SEPA access: possibility of international transfers

- Multicurrency: support for USD, EUR, local currency

- Transaction limits: daily, monthly limits

- Remote management: mobile application, Internet bank

- Fees: for servicing, currency operations, transfers

- Geography of use: country restrictions

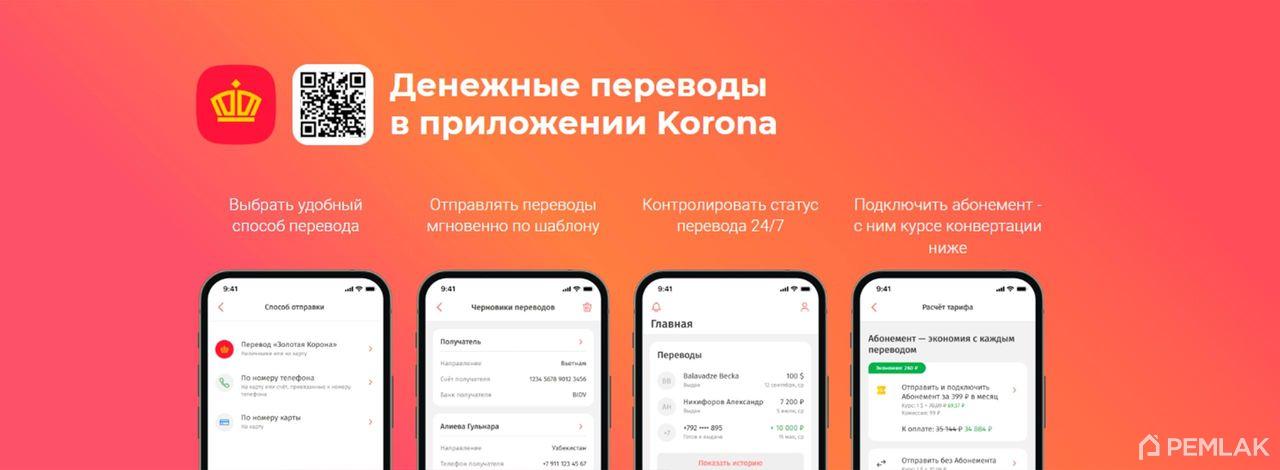

Money transfers of "KoronaPay" system

KoronaPay remains one of the working solutions for international transfers from Russia to Turkey in 2025.

How does KoronaPay work in Turkey?

What it is: an international money transfer system that allows you to send money from Russia with cash receipt in Turkey.

Receiving remittances in Turkey

PTT (Turkish Post) through "Global Ödeme Hizmetleri":

- Issuance by transfer code and recipient's passport

- Available currencies: TRY, USD, EUR (depends on sender's settings)

- Network: more than 7,000 branches all over Turkey

- Opening hours: usually from 08:30 to 17:30 on weekdays

Partner payment services:

- Global Ödeme: specialized drop-off points

- UPT: cash or card/account withdrawals

- Local agents: in tourist areas

How to send a transfer via KoronaPay ?

Sending procedure:

- Install KoronaPay mobile application

- Register and verify

- Bind a Russian bank card

- Choose the direction "Russia → Turkey"

- Specify recipient's data and currency of issue

- Pay the transfer from the card

Limits and commissions:

- Minimum amount: 1,000 rubles

- Maximum amount: 600,000 rubles per transaction

- Commission: 1-3% of the transfer amount

- Exchange rate: set by the system, usually 1-2% worse than the bank rate

Recommendations:

- For large sums, split the transfer into several operations

- Reserve time (up to 3-5 working days)

- Keep all documents and transfer codes

Use for real estate purchase

For real estate: transfers via KoronaPay are suitable for making a deposit or reservation, but have limitations:

Pros:

- Quick receipt of funds to the recipient

- Official documentation of the transaction

- Availability in most Turkish cities

Minuses:

- Cash from the transfer does not replace the certificate requirement

- Banks require bank verification of origin of funds for full settlement of the transaction

- Amount limits may not be sufficient for real estate purchases

Cryptocurrency payment cards

In 2025, cryptocurrency cards have become an alternative solution for international payments, but availability for Russians is limited by sanctions.

Bybit Card

Bybit Card is a special cryptocurrency card from the Bybit exchange, everyone can get it for free. Such a card can be replenished and used both in Turkey and in other countries. A gift is available for all users when you sign up for the card via this link, 10$ after issuance.

Requirements to obtain:

- Confirmed address abroad

- Extended KYC verification

For Russians: the card is available if the address abroad is verified on the exchange. A foreign passport will be suitable for KYC verification.

Features of use:

- Deposit: BTC, ETH, USDT and other cryptocurrencies

- Limits: up to €10,000 per month

- Commissions: 0.9% for converting cryptocurrencies to fiat

- Geography: accepted wherever Mastercard works

MuseWallet Card

This cryptocurrency wallet appeared on the market not so long ago, but has already earned the trust of many customers. Thanks to a large selection of cryptocurrencies, users from all over the world can get them. For Russians, both virtual and physical Visa cards are available. Download the cryptocurrency wallet and issue a card at this link.

Requirements for obtaining one:

- Passing KYC verification

For Russians: Visa card is available both virtual and physical. A foreign passport will be suitable for KYC verification.

Features of use:

- Deposit: BTC, ETH, USDT and other cryptocurrencies

- Geography: accepted everywhere Visa works

Practical recommendations on the choice

For tourists and short-term trips

Optimal strategy:

- Main decision: foreign card or cryptocurrency card

- Reserve: cash USD/EUR + UnionPay

- Small transfers: KoronaPay for emergencies

For real estate buyers

Preparing for the transaction:

- In advance: open a Turkish bank account or get a card in a friendly country

- Downpayment: can use KoronaPay or cash

- Principal payment: wire transfer with receipt of certificate

Risk diversification

Do not rely on one payment method:

- Political changes can block any system

- Technical glitches happen in all payment solutions

- Combination of 2-3 methods ensures financial security

Cashless payments for Russians in 2025 require a comprehensive approach and pre-planning. UnionPay remains unstable, Mir cards do not work, but solutions through banks of friendly countries and cryptocurrency are available. For large transactions, especially those involving real estate, compliance with Turkish currency laws and origin of funds requirements is essential.

Payment in Turkey by QR code, how to pay via VTB, Sber and MTS

This year Russian tourists, relocants have received a new opportunity for convenient payment for purchases - the system of QR-payments through popular banking applications. We will analyze in detail this method of payment in Turkey as well

What is TR QR and how does it work?

TR QR ( karekod in Turkish) is a single national standard for QR payments, developed by the Central Bank of Turkey and supported by the vast majority of POS-terminals in the country. According to official statements, the system coverage reaches 95% of all retail outlets, which makes TR QR one of the most accessible cashless payment methods in Turkey.

The system works on the principle of a dynamic QR code: each transaction generates a unique code with encrypted information about the amount of payment, details of the recipient and a time stamp. This ensures a high level of security and eliminates the possibility of reusing a single code for fraudulent transactions.

In early 2025, Russian banks integrated with Turkey's TR QR system, opening up new opportunities for Russian customers. VTB and MTS Bank launched the service on March 12, 2025, Sberbank announced general access at the end of March with a phased connection of all customers.

Who already supports payment by QR ?

VTB offers payment in rubles with automatic conversion to Turkish lira at the current exchange rate of the bank. A limit of up to 350,000 rubles per transaction is set, which covers most everyday spending and large purchases. The service works throughout Turkey without geographical restrictions.

MTS Bank launched TR QR support without charging commissions for transactions. The peculiarity of the service is the possibility to pay not only from a bank card, but also from MTS mobile balance, which is convenient for the operator's customers.

Sberbank enabled broad access to all customers after a test period. In 2024 the bank used a partner scheme via Metropol and payinturkey, but in 2025 moved the service to a native QR stream for more stable operation.

Alfa Bank has not officially announced the launch of the service in Turkey as of mid-summer 2025. According to unofficial sources, technical integration is under development, but no specific launch dates have been announced. Alfa-Bank customers are advised to check the latest information with the bank's support service before traveling.

Requirements for QR payments in Turkey

To use QR payments in Turkey, a minimum set of tools is required:

Asmartphone with an installed banking application(VTB Online, SberBank Online or My MTS) and a stable internet connection. The system works both with mobile internet and Wi-Fi connection.

Anactive bank card linked to the application. Mir, Visa and Mastercard cards issued by Russian banks are supported. Funds are debited directly through the mobile application without the need to physically present the card.

Important detail: at the cash desk you should ask for payment by karekod (pronounced "karekod"). Many cashiers in tourist areas know this word, but it's also helpful to know the English equivalent of "QR payment" or show the scanning gesture with your phone.

Commission, conversion, limits

One of the main advantages of the system is the transparency of financial conditions. The payment is debited in rubles with automatic conversion into Turkish liras at the bank's exchange rate at the time of the transaction. All participating banks state that there is no commission for QR-payments in Turkey.

VTB has set a maximum limit of 350,000 rubles per transaction, which is equivalent to about $3,500-4,000 at the current exchange rate. This limit is sufficient for most purchases, including large household appliances, jewelry or deposits when booking services.

MTS Bank and Sberbank have not published specific limits, but in practice the limits correspond to the standard daily limits on customers' cards.

The conversion rate is applied at the time of payment authorization, which means that the exchange rate is fixed in real time. This protects against currency fluctuations in the moment between transaction initiation and completion.

Where does it really work in Turkey ?

QR payments via TR QR work in a wide range of commercial outlets across Turkey. Supermarkets of major chains including Migros, Carrefour, BIM are actively supporting the system at all checkout points.

Restaurants and cafes of international brands almost universally accept QR payment: Burger King, McDonald's, KFC, Starbucks, Subway. Local establishments in tourist areas have also joined the system en masse.

Clothing and accessories retail chains actively use TR QR: LC Waikiki, Mavi, Colin's, DeFacto, Koton. In shopping centers almost all stores support the system.

Gas stations of major chains Shell, BP, Opet, Petrol Ofisi are fully integrated with the QR-payment system.

Pharmacies, museums, transportation services (including cabs with modern terminals) also support payment by karekod.

Infrastructure limitations

Despite high coverage, there are technical limitations. Older POS terminals without a color screen cannot generate a QR code for scanning. In such cases, you should ask the cashier to switch to a more modern terminal or use an alternative payment method.

Small family-owned stores and market vendors may not have TR QR support due to the use of simplified cashier systems.

Internet coverage may affect the speed of payment processing in remote areas or basement areas of shopping centers.

Step-by-step QR payment scenarios

Via VTB Online

The payment process through the VTB app is intuitive and takes no more than a minute:

- Preparation: Make sure you have a stable internet connection and open the VTB Online app

- Initiate payment: Select "Pay by QR" from the main menu or use the corresponding icon on the home screen

- Scan: Point your smartphone camera at the karekod displayed on the POS terminal screen

- Confirmation: Check the payment amount in rubles (including conversion) and confirm the operation

- Completion: Wait for confirmation of successful payment and save the receipt in the application

VTB feature: the system automatically selects the most favorable conversion rate available at the time of the transaction.

Via SberBank Online

Sberbank offers a simplified interface for QR payments:

- Launch: Open the SberBank Online application and log in

- Navigation: Find the "Pay by QR" function in the main menu or Payments section

- Scan: Focus the camera on the karekod and wait for automatic recognition

- Verification: Make sure the amount and recipient details are correct

- Authorization: Confirm payment using PIN, biometrics or SMS code

In 2025, Sberbank fully switched to native integration with TR QR, abandoning partner schemes through intermediate services.

Through My MTS

MTS offers a unique opportunity to pay from your mobile balance:

- Login: Launch the My MTS app and go to the Money section

- Selecting a function: Find "Pay by QR code" in the list of available operations

- Scanning: Use the built-in QR scanner to read the karekod

- Selecting the source of funds: Choose between a bank card from any Russian bank or MTS balance

- Confirmation: Complete the transaction according to the selected payment method

Advantage of MTS: possibility to pay even if there are no bank cards, using mobile balance.

Practical tips for use

Preparing for a trip

One week before departure:

- Update your banking applications to the latest versions

- Check if the QR-payment function is active in the settings

- Make sure you have sufficient funds on your cards

- Enable transaction notifications to monitor spending

At the airport/on arrival:

- Check mobile internet functionality

- Test the QR scanning feature in the app

- Check with your tour operator or hotel for the most popular TR QR-enabled outlets

Optimal payment strategy

For tourists: Use QR payments for most purchases in large shopping centers, restaurants, supermarkets. Keep a small amount of cash for markets, street food, tipping.

For Relocants: QR payments are ideal for the adaptation period when you haven't yet opened a local bank account. Gradually switch to local banking products for long-term stays.

For real estate buyers: Consider QR payments as a convenient tool for recurring expenses, but plan separate channels for major financial transactions related to the transaction.

QR payments via TR QR represent a modern and convenient solution for Russians in Turkey, significantly simplifying the cashless payment process. Integration of leading Russian banks with the Turkish national system opens up new opportunities for a comfortable stay in the country.

The system is particularly attractive due to the absence of commissions, high coverage of retail outlets and ease of use. However, it is important to keep in mind the limitations and always have backup payment methods.

For maximum efficiency, it is recommended to combine QR payments with traditional methods: cash for small purchases and tips, bank transfers for large transactions, especially those related to buying real estate in Turkey.

Where to change cryptocurrency in Turkey and how to pay ?

The cryptocurrency market in Turkey is undergoing significant regulatory changes. On February 25, 2025, new Travel Rule requirements came into effect, requiring crypto businesses to hand over data on all transactions of 15,000 Turkish Liras or more. The licensing requirements for exchanges and exchanges under the control of CMB and MASAK are strengthened .

This means that the KYC procedure is now mandatory for all cryptocurrency transactions, and large withdrawals and exchanges may be delayed due to additional checks. Russian users should prepare for stricter paperwork and possible restrictions when working with cryptocurrency services in Turkey.

Where to exchange cryptocurrency for cash in Turkey?

OTC offices in major cities

In Istanbul, Antalya and other tourist centers there are specialized OTC exchange offices offering the exchange of USDT, Bitcoin and other popular cryptocurrencies for cash in US dollars, euros or Turkish lira. Among the well-known services are NakitCoins and InstaXchange, which have physical offices and work with passport data of clients.

Important nuances when working with OTC offices:

- Obligatory presentation of passport or ID document

- Commissions vary from 2% to 5% depending on the amount and currency pair

- It is necessary to clarify limits and availability of reserves in the cash desk in advance

- It is recommended to check the reputation of the office and read reviews of other users

Local crypto exchanges

Turkish exchanges BtcTurk, Paribu, Binance TR offer deposits and withdrawals in Turkish lira through local banks. However, the verification procedure is much more complicated for non-residents and access to fiat transactions may be limited.

To successfully operate Turkish exchanges, non-residents usually require:

- Turkish tax number (vergi numarası)

- Proof of address in Turkey

- Extended identity verification

- Bank account in a Turkish bank for withdrawal of funds

Buying real estate in Turkey with cryptocurrency

For real estate buyers planning to use cryptocurrencies, the following scheme is recommended:

- Selling USDT via OTC or exchange with receipt of Turkish Liras to a Turkish bank account

- Issuance of a "döviz alim belgesi" (currency purchasecertificate ) at the bank

- Cashless transfer to the seller or issuing a bank check for the transaction

- Submission of documents to Tapu (cadastral chamber) for registration of the transfer of ownership rights

Direct cryptocurrency payment to the seller does not formally meet the requirements of Turkish law for registration of real estate transactions. All large real estate purchases must go through the banking system with appropriate certificates of origin of funds. You can read more about this in our blog at this link.

Risks and when working with cryptocurrencies

The main risks for Russian users

The use of cryptocurrencies in Turkey involves several categories of risks:

Regulatory risks:

- Tightening of requirements for verification of sources of funds

- Possible transaction delays due to AML checks

- Changes in legislation affecting the availability of services

Operational risks:

- Volatility of cryptocurrency exchange rates

- Technical failures on exchanges and wallets

- Security risks when storing private keys

Tax aspects: Turkey is discussing the introduction of a transaction tax on operations with cryptoassets. Russian users should also consider tax obligations in their jurisdiction of residence when conducting large cryptocurrency transactions.

Recommendations for minimizing risks

- Diversify payment methods - do not rely solely on cryptocurrencies

- Small test transactions before large transfers

- Keep detailed documentation of all transactions for tax reporting purposes

- Use only trusted services with a good reputation

- Consultation with lawyers when planning large real estate transactions

What is the best way to pay in Turkey?

There is no right answer to this question and it is better to use several ways at once.

When traveling, money is not one tool, but a bunch of keys to different doors. The world of rules changes faster than routes: today the terminal accepts UnionPay, tomorrow - only TR QR; in one neighborhood the exchanger willingly accepts new "blue" hundreds, in another - asks for another series. Therefore, the real comfort is not in the "magic card", but in flexibility.

The idea is simple: don't choose one method, make a set. Take some fresh USD/EUR in cash, keep working banking apps for QR payments, add KoronaPay for small transfers, prepare a foreign card and a small reserve in USDT for quick liquidity via a trusted OTC. This is how you turn randomness into a plan: if one door is closed, you have four more. This is how "how Russians can pay abroad" stops being a problem and becomes a strategy.

Frequently Asked Questions (FAQ)

1. Can Russians use cash dollars in Turkey in 2025? Yes, cash US dollars remain one of the main payment methods for Russians in Turkey. It is recommended to take new $100 denomination bills with blue security tape, as older series and "white dollars" may not be accepted due to increased counterfeiting.

2. Which banknotes are best to take with you to Turkey? Preferably new US dollars and euros in large denominations ($100, €100, €200) in perfect condition. Rubles are changed very rarely and at an unfavorable exchange rate, so it is better to exchange them for USD/EUR back in Russia.

3. Where is the best place to exchange currency in Turkey? Banks usually offer more honest rates, but require a passport when exchanging large sums. Exchange offices in tourist areas work without documents, but the rate may be less favorable. Always have a backup plan - several banks or exchangers.

4. What is the limit on taking cash currency out of Russia? The limit is $10,000 or equivalent in other currencies per person. Amounts over this limit are subject to customs declaration.

5. Do UnionPay cards work in Turkey in 2025? Partially. Some Russian banks still issue UnionPay cards, but their acceptance in Turkey is unstable and occurs in "spots". It is recommended to consider UnionPay only as an additional payment method, not the main one.

6. Where can I open a bank card for a non-resident of Russia? The most available options are Armenia (Ameriabank, IDBank), Kyrgyzstan (DemirBank KG, Optima Bank), Kazakhstan (Halyk, Jusan), Georgia (TBC, Bank of Georgia). In most cases, a personal visit, passport, proof of address and local tax number are required.

7. Can a non-resident open a bank account in Turkey? Yes, but the procedure is complicated. It requires a Turkish tax number, proof of address, and strict compliance procedures. The banks' policy towards non-residents is quite strict, especially towards citizens of countries under sanctions.

8. What is "KoronaPay" and how does it work in Turkey? KoronaPay is a system of international transfers from Russia. In Turkey, transfers can be received through PTT (Turkish Post) and partner networks in TRY, EUR or USD. A passport and a transfer code are required.

9. Are cryptocurrencies legal in Turkey? Yes, cryptocurrencies are legal, but strict AML and Travel Rule requirements are in place from 2025. All transactions over 15,000 TRY are subject to mandatory reporting and KYC is required.

10. Where can I exchange USDT for cash in Turkey? At specialized OTC offices in Istanbul, Antalya and other major cities. Examples: NakitCoins, InstaXchange. Passport is required, commission is usually 2-5%.

11. Can I use cryptocurrencies in Turkey? Yes, some international cryptocurrencies work in Turkey. Popular options are MuseWallet, SWT Wallet, Bybit Card. KYC and address verification is required.

12. How to buy real estate in Turkey with cryptocurrency? Direct payment with cryptocurrency does not meet Tapu's requirements. Recommended scheme: sell crypto → receive TRY to Turkish bank account → issue a certificate "döviz alim belgesi" → cashless payment to the seller.

13. What risks are associated with the use of cryptocurrencies in Turkey? The main risks are: volatility of exchange rates, tightening of regulation, possible delays due to AML inspections, technical failures on exchanges, tax liabilities in the jurisdiction of residence.

14. Can I make a deposit for an apartment in cash? Yes, the deposit can be paid in cash, but the banks and the cadastre will require bank documents on the origin of the funds and a "döviz alim belgesi" certificate for final settlement.

15. How to fix the exchange rate when buying real estate? Discuss with the seller the possibility of fixing the exchange rate on a certain date or using the weighted average rate of the Central Bank of Turkey on the day of the transaction. Include the relevant clause in the preliminary contract.

16. Do I have to notify the Russian Federal Tax Service about opening an account in a foreign bank? Yes, if you are a tax resident of Russia and have opened an account in a foreign bank, you must submit a notification to the Federal Tax Service within 30 days and file an annual report on the movement of funds.

17. What fees do Turkish banks charge for non-resident transactions? The fees vary depending on the bank: opening an account $50-200, account maintenance $10-50 per month, transfers 0.1-1% of the amount, cash withdrawals $2-10 per transaction plus interest.

18. Can a non-resident get a mortgage in a Turkish bank? It is possible, but the conditions are strict: down payment from 50%, proof of income in the country of residence, guarantors or collateral, high interest rates.

19. What to do if the card is blocked in Turkey? Immediately contact the issuing bank via hotline or mobile application. Often blockings are related to suspicious transactions - confirm your location and purpose of travel.

20. Can I pay with rubles in Turkey? Technically yes, but it is extremely unprofitable. The ruble exchange rate in Turkish exchangers is much worse than the official one, many points do not work with rubles at all. It is better to exchange in Russia for USD/EUR.

Comments 1

Vlad Tikh

Очень полезная статья. Спасибо

15.08.2025